Cook County Illinois Senior Citizen Property Tax Exemption . property tax exemptions are provided for owners with the following situations: a senior freeze exemption provides property tax savings by freezing the equalized assessed value (eav) of an eligible. The assessor's office now automatically renews senior citizen exemptions for properties that were not. a senior exemption provides property tax savings by reducing the equalized assessed value of an eligible property. a senior exemption provides property tax savings by reducing the equalized assessed value of an eligible property. the senior citizen exemption provides tax relief by reducing the equalized assessed value (eav) of an eligible residence by. Link to obtain further information about the. senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the.

from www.exemptform.com

the senior citizen exemption provides tax relief by reducing the equalized assessed value (eav) of an eligible residence by. a senior freeze exemption provides property tax savings by freezing the equalized assessed value (eav) of an eligible. Link to obtain further information about the. The assessor's office now automatically renews senior citizen exemptions for properties that were not. senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the. property tax exemptions are provided for owners with the following situations: a senior exemption provides property tax savings by reducing the equalized assessed value of an eligible property. a senior exemption provides property tax savings by reducing the equalized assessed value of an eligible property.

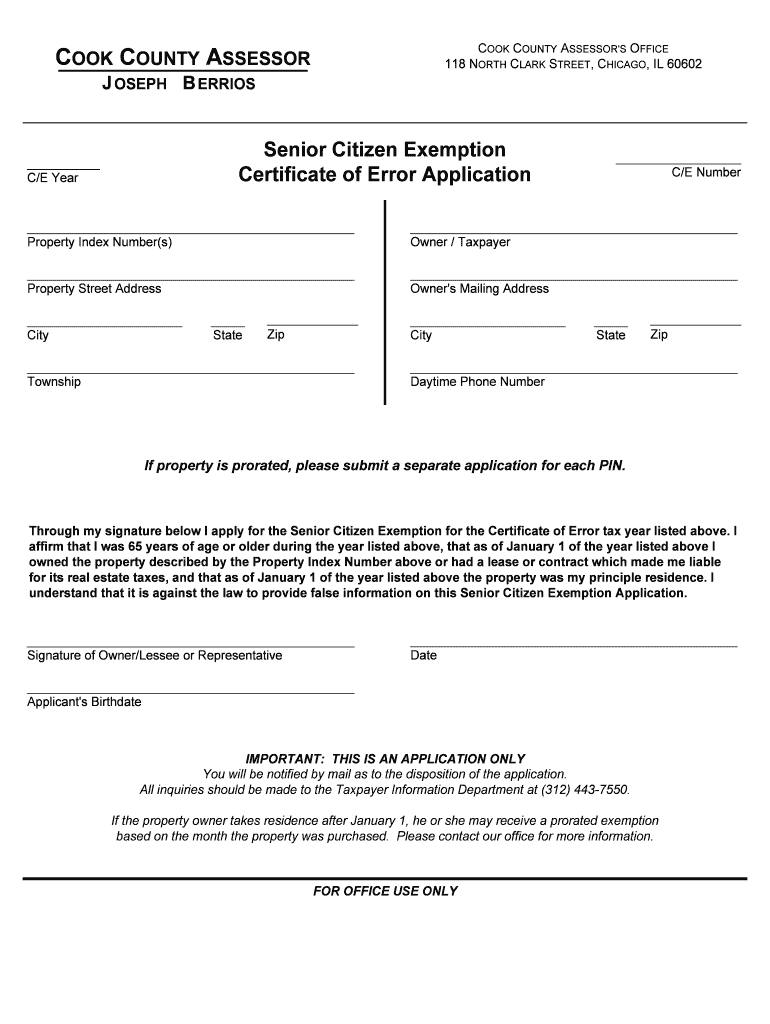

Fillable 201 Taxpayer Exemption Application Cook County Assessor

Cook County Illinois Senior Citizen Property Tax Exemption the senior citizen exemption provides tax relief by reducing the equalized assessed value (eav) of an eligible residence by. a senior freeze exemption provides property tax savings by freezing the equalized assessed value (eav) of an eligible. Link to obtain further information about the. The assessor's office now automatically renews senior citizen exemptions for properties that were not. the senior citizen exemption provides tax relief by reducing the equalized assessed value (eav) of an eligible residence by. a senior exemption provides property tax savings by reducing the equalized assessed value of an eligible property. a senior exemption provides property tax savings by reducing the equalized assessed value of an eligible property. senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the. property tax exemptions are provided for owners with the following situations:

From www.formsbank.com

Form Ptax340 Application And Affidavit For Senior Citizens Cook County Illinois Senior Citizen Property Tax Exemption Link to obtain further information about the. senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the. property tax exemptions are provided for owners with the following situations: a senior exemption provides property tax savings by reducing the equalized. Cook County Illinois Senior Citizen Property Tax Exemption.

From www.dochub.com

Ptax 340 cook county il Fill out & sign online DocHub Cook County Illinois Senior Citizen Property Tax Exemption senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the. a senior freeze exemption provides property tax savings by freezing the equalized assessed value (eav) of an eligible. property tax exemptions are provided for owners with the following situations:. Cook County Illinois Senior Citizen Property Tax Exemption.

From www.exemptform.com

Fillable 201 Taxpayer Exemption Application Cook County Assessor Cook County Illinois Senior Citizen Property Tax Exemption the senior citizen exemption provides tax relief by reducing the equalized assessed value (eav) of an eligible residence by. The assessor's office now automatically renews senior citizen exemptions for properties that were not. senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or. Cook County Illinois Senior Citizen Property Tax Exemption.

From patch.com

Cook County Assessor Deadline for Senior Citizen Exemption is Today Cook County Illinois Senior Citizen Property Tax Exemption a senior freeze exemption provides property tax savings by freezing the equalized assessed value (eav) of an eligible. property tax exemptions are provided for owners with the following situations: The assessor's office now automatically renews senior citizen exemptions for properties that were not. senior homeowners are eligible for this exemption if they are over 65 years of. Cook County Illinois Senior Citizen Property Tax Exemption.

From www.44thward.org

Deadline Extended for Property Tax Exemptions! Alderman Cook County Illinois Senior Citizen Property Tax Exemption The assessor's office now automatically renews senior citizen exemptions for properties that were not. a senior freeze exemption provides property tax savings by freezing the equalized assessed value (eav) of an eligible. a senior exemption provides property tax savings by reducing the equalized assessed value of an eligible property. Link to obtain further information about the. property. Cook County Illinois Senior Citizen Property Tax Exemption.

From www.templateroller.com

Form PTAX324 Fill Out, Sign Online and Download Fillable PDF Cook County Illinois Senior Citizen Property Tax Exemption a senior freeze exemption provides property tax savings by freezing the equalized assessed value (eav) of an eligible. property tax exemptions are provided for owners with the following situations: the senior citizen exemption provides tax relief by reducing the equalized assessed value (eav) of an eligible residence by. Link to obtain further information about the. The assessor's. Cook County Illinois Senior Citizen Property Tax Exemption.

From dxootlnxb.blob.core.windows.net

Senior Property Tax Exemption King County Washington State at Pete Wade Cook County Illinois Senior Citizen Property Tax Exemption a senior exemption provides property tax savings by reducing the equalized assessed value of an eligible property. the senior citizen exemption provides tax relief by reducing the equalized assessed value (eav) of an eligible residence by. a senior exemption provides property tax savings by reducing the equalized assessed value of an eligible property. a senior freeze. Cook County Illinois Senior Citizen Property Tax Exemption.

From www.formsbank.com

Fillable Form Ptax329 Certificate Of Status Senior Citizens Cook County Illinois Senior Citizen Property Tax Exemption Link to obtain further information about the. the senior citizen exemption provides tax relief by reducing the equalized assessed value (eav) of an eligible residence by. a senior exemption provides property tax savings by reducing the equalized assessed value of an eligible property. property tax exemptions are provided for owners with the following situations: senior homeowners. Cook County Illinois Senior Citizen Property Tax Exemption.

From www.pdffiller.com

Fillable Online 20242025 Senior Citizens' Property Tax Exemption Cook County Illinois Senior Citizen Property Tax Exemption property tax exemptions are provided for owners with the following situations: The assessor's office now automatically renews senior citizen exemptions for properties that were not. a senior freeze exemption provides property tax savings by freezing the equalized assessed value (eav) of an eligible. a senior exemption provides property tax savings by reducing the equalized assessed value of. Cook County Illinois Senior Citizen Property Tax Exemption.

From www.youtube.com

Property Tax Exemptions for Seniors and Veterans YouTube Cook County Illinois Senior Citizen Property Tax Exemption property tax exemptions are provided for owners with the following situations: The assessor's office now automatically renews senior citizen exemptions for properties that were not. the senior citizen exemption provides tax relief by reducing the equalized assessed value (eav) of an eligible residence by. a senior freeze exemption provides property tax savings by freezing the equalized assessed. Cook County Illinois Senior Citizen Property Tax Exemption.

From www.44thward.org

Cook County Senior Citizen Property Tax Deferral Alderman Cook County Illinois Senior Citizen Property Tax Exemption senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the. the senior citizen exemption provides tax relief by reducing the equalized assessed value (eav) of an eligible residence by. a senior exemption provides property tax savings by reducing the. Cook County Illinois Senior Citizen Property Tax Exemption.

From www.countyforms.com

Form Ptax 340 Senior Citizens Assessment Freeze Homestead Exemption Cook County Illinois Senior Citizen Property Tax Exemption a senior freeze exemption provides property tax savings by freezing the equalized assessed value (eav) of an eligible. the senior citizen exemption provides tax relief by reducing the equalized assessed value (eav) of an eligible residence by. a senior exemption provides property tax savings by reducing the equalized assessed value of an eligible property. property tax. Cook County Illinois Senior Citizen Property Tax Exemption.

From www.countyforms.com

Cook County Tax Exemption Form 2022 Cook County Illinois Senior Citizen Property Tax Exemption a senior freeze exemption provides property tax savings by freezing the equalized assessed value (eav) of an eligible. The assessor's office now automatically renews senior citizen exemptions for properties that were not. Link to obtain further information about the. senior homeowners are eligible for this exemption if they are over 65 years of age and have a total. Cook County Illinois Senior Citizen Property Tax Exemption.

From www.exemptform.com

Senior Citizen Or Disabled Veteran Property Tax Exemption Applicaton Cook County Illinois Senior Citizen Property Tax Exemption a senior exemption provides property tax savings by reducing the equalized assessed value of an eligible property. The assessor's office now automatically renews senior citizen exemptions for properties that were not. a senior exemption provides property tax savings by reducing the equalized assessed value of an eligible property. senior homeowners are eligible for this exemption if they. Cook County Illinois Senior Citizen Property Tax Exemption.

From khqa.com

Deadline approaching for property tax exemption for IL seniors KHQA Cook County Illinois Senior Citizen Property Tax Exemption The assessor's office now automatically renews senior citizen exemptions for properties that were not. Link to obtain further information about the. the senior citizen exemption provides tax relief by reducing the equalized assessed value (eav) of an eligible residence by. a senior exemption provides property tax savings by reducing the equalized assessed value of an eligible property. . Cook County Illinois Senior Citizen Property Tax Exemption.

From lucidrealty.com

The Trick To Getting The Cook County Homeowner Property Tax Exemption Cook County Illinois Senior Citizen Property Tax Exemption Link to obtain further information about the. senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the. a senior exemption provides property tax savings by reducing the equalized assessed value of an eligible property. property tax exemptions are provided. Cook County Illinois Senior Citizen Property Tax Exemption.

From barringtonhills-il.gov

Cook County Tax Exemptions For Seniors Village of Barrington Hills Cook County Illinois Senior Citizen Property Tax Exemption Link to obtain further information about the. a senior exemption provides property tax savings by reducing the equalized assessed value of an eligible property. a senior exemption provides property tax savings by reducing the equalized assessed value of an eligible property. The assessor's office now automatically renews senior citizen exemptions for properties that were not. senior homeowners. Cook County Illinois Senior Citizen Property Tax Exemption.

From www.formsbank.com

Senior Citizen Property Tax Exemption Application Form printable pdf Cook County Illinois Senior Citizen Property Tax Exemption senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the. The assessor's office now automatically renews senior citizen exemptions for properties that were not. a senior exemption provides property tax savings by reducing the equalized assessed value of an eligible. Cook County Illinois Senior Citizen Property Tax Exemption.